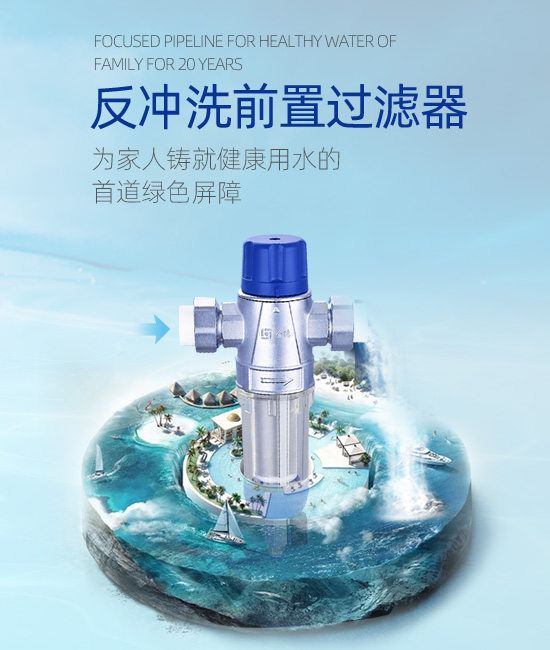

瑧品质 · 臻服务 · 真健康

好管好家,好金德

热点视频 SPOTLIGHT

VIDEOS

集团动态 GROUP DYNAMICS

诚信315|品质铸就辉煌,服务赢得信赖

热点视频

——— — HOT VIDEO — ———集团动态

——— — NEWS AND INFORMATION — ———

版权所有: 三码必中一码 COPYRIGHT © 1999-2019 Corp.Ltd.All Rights Reserved ICP证号:辽ICP备14012421号 辽公网安备:21010502000743号